Related Posts

The State of GHG Emissions Planning in Oil and Gas

Even the most ambitious energy transition plans still include the production and consumption of significant amounts of oil and gas until 2050 and beyond.

Three Reasons Oil & Gas Companies Are Planning for Net-Zero

Reduce exposure to regulations, create transparent future emissions forecasts to attract capital, and enable a balanced mix of sustainable energy sources.

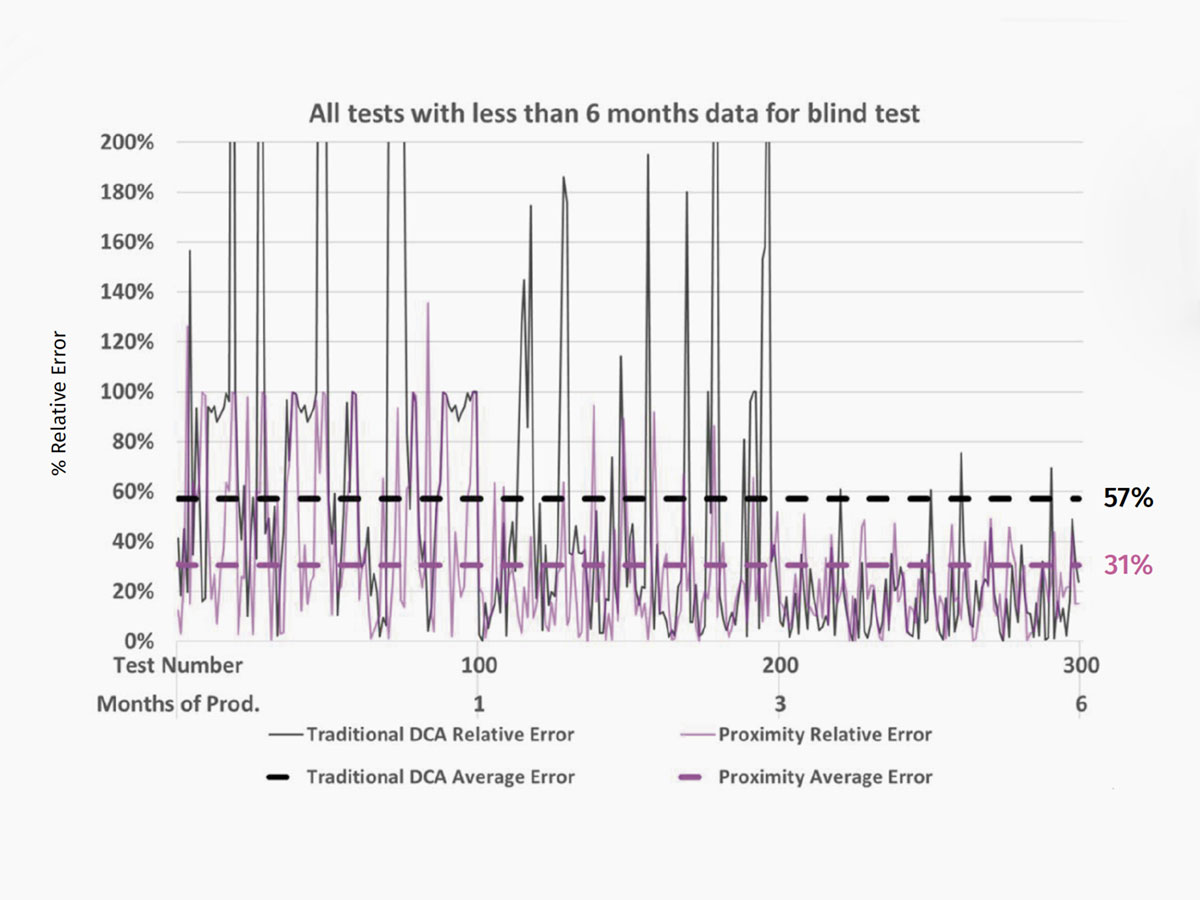

ComboCurve Proximity vs. Traditional DCA Forecast: A Comprehensive Comparison Study

ComboCurve’s proximity workflow generates a forecast with a much lower error compared to the traditional DCA.