How Zephyr Optimizes Deal Evaluation and Forecasting with ComboCurve

Zephyr streamlined deal evaluation and forecasting by replacing Excel and Aries with ComboCurve’s intuitive, cloud-based platform. The shift accelerated economic modeling, improved collaboration, and enhanced decision-making across its lean operations.

Gregor Maxwell, COO at Zephyr, leads the company’s operations, analytics, and technical strategy using ComboCurve to drive data-driven decision-making. Focused on production in the Dakotas and appraisal projects in Utah’s Paradox Basin, Zephyr operates with a lean team, requiring efficient workflows and accurate forecasting.

Challenges Before ComboCurve

Before adopting ComboCurve, Zephyr relied on a combination of Excel, IHS Harmony, and Aries for economic modeling and forecasting. However, these tools presented significant limitations:

- Required manual data input and became difficult to manage beyond 15-20 wells.

- Considered outdated, difficult to QC, and inefficient for rapid deal evaluation.

- Used for type curve modeling, but lacked robust economic modeling capabilities.

“Once I started to get beyond 15-20 wells, it became difficult. And then that’s when we picked up Aries. Aries was very tough to pick up from scratch and non-intuitive. And then we went straight to ComboCurve, which is, I think, a far more intuitive tool.” – Gregor Maxwell

Zephyr needed a cloud based solution that could streamline its forecasting and economic analysis while integrating seamlessly with its financial models.

Why ComboCurve?

Zephyr transitioned to ComboCurve because of its intuitive, web-based platform that simplifies economic modeling and forecasting. Key advantages of ComboCurve over previous tools included:

- Rapid Analysis: Enabled Zephyr to perform economic evaluations quickly and efficiently.

- User-Friendly Interface: Easy to use, allowing broader team collaboration.

- Integration with DI Data: Allowed the upload of entire basins for enhanced forecasting insights

- Improved Forecasting Capabilities: Provided better first-year cumulative production matching and allowed for validation using multiple forecasting methods.

“It’s easy to use. I think any discipline that works in oil and gas could pick this up and use it, which I think is good for us for a small team.” – Gregor Maxwell

Implementation and Impact

Since integrating ComboCurve, Zephyr has transformed its workflows, particularly in the following areas:

- Deal Evaluation:

- Simplified process for economic assessments, reducing reliance on manual Excel models.

- Production and Financial Modeling:

- All production data is now stored and analyzed within ComboCurve.

- Forecast data is seamlessly integrated into Zephyr’s financial models.

- Automated import of daily and monthly production data

- Operational Efficiency:

- Reduced time spent on manual forecasting and economic analysis.

- Enabled rapid decision-making for optimizing well performance and gas processing constraints.

- Customer Support and User Experience:

- ComboCurve’s support team provides quick responses and hands-on assistance.

- Unlike legacy software providers, issues are addressed promptly without long support queues.

“You guys are just great. We live in a world of queues, going on hold and automated responses… and it’s great when you just get a person emailing you back. Hey, I’ll help you out… Let’s get on a team’s session. Let’s sort it out. That is, to me, that’s really valuable.” – Gregor Maxwell

Looking Ahead

As Zephyr continues to scale its operations, ComboCurve remains a key part of the decision-making process. The company plans to further integrate ComboCurve’s advanced analytical capabilities and enhanced forecasting methodologies to deepen its insights into asset performance and production potential.

Conclusion

By adopting ComboCurve, Zephyr has significantly improved its deal evaluation process, streamlined economic modeling, and enhanced operational efficiency. The transition from outdated legacy tools to an intuitive, web-based platform has positioned Zephyr to make faster, more informed decisions in a competitive E&P landscape.

Recommendation

Are you ready to transform your deal evaluation and forecasting workflows like Zephyr? ComboCurve’s intuitive, cloud-based platform is designed to help E&P companies of all sizes optimize their operations, reduce manual work, and make faster, more informed decisions. Reach out to schedule a personalized demo and discover how ComboCurve can give your team the tools they need to succeed in a competitive energy market.

See how your team can go from forecast to economics in minutes with energy’s fastest analysis engine.

Related Posts

September 29, 2022

The State of GHG Emissions Planning in Oil and Gas

Even the most ambitious energy transition plans still include the production and consumption of significant amounts of oil and gas until 2050 and beyond.

October 20, 2022

Three Reasons Oil & Gas Companies Are Planning for Net-Zero

Reduce exposure to regulations, create transparent future emissions forecasts to attract capital, and enable a balanced mix of sustainable energy sources.

October 22, 2022

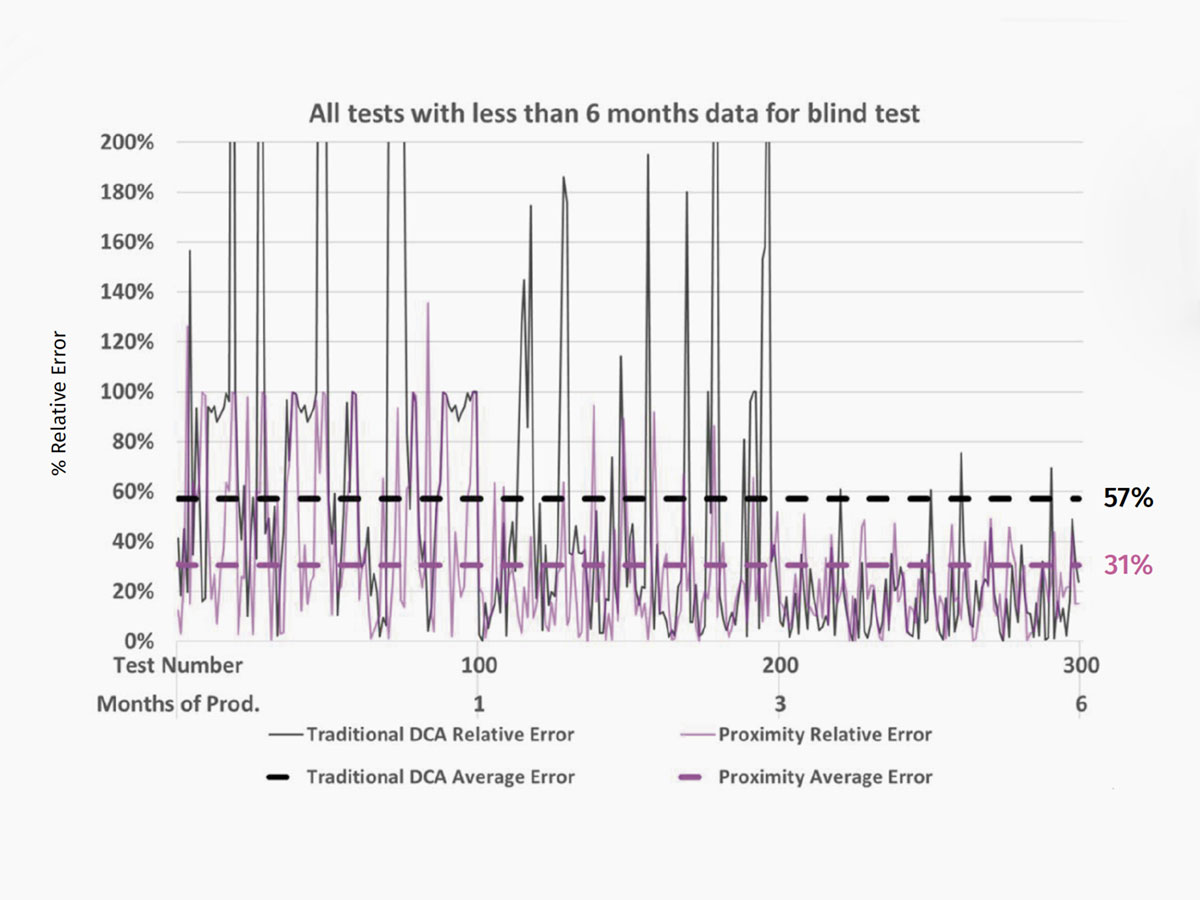

ComboCurve Proximity vs. Traditional DCA Forecast: A Comprehensive Comparison Study

ComboCurve’s proximity workflow generates a forecast with a much lower error compared to the traditional DCA.