How We’re Breaking the Barrier – A Conference Recap

Last week, ComboCurve and Ryder Scott hosted a pioneering collaboration event that brought together industry leaders, experts, and innovators in reservoir engineering, environmental engineering, and sustainability for two dynamic days of engaging talks, insightful panels, and the unique opportunity to earn a new Carbon Reserves Certification.

Last week, ComboCurve and Ryder Scott hosted a pioneering collaboration event that brought together industry leaders, experts, and innovators in reservoir engineering, environmental engineering, and sustainability for two dynamic days of engaging talks, insightful panels, and the unique opportunity to earn a new Carbon Reserves Certification.

Best Of Oil And Gas Tech Meets The Best Of Evaluations

“We’re partnering to unite Ryder Scott’s expertise in reserves, emissions, and engineering with ComboCurve’s strengths in technology, reserves, and workflows. Our vision is to integrate these areas to make business operations more manageable for you.” – Doug McMaster, Executive VP of Product Development at ComboCurve.

In light of the recent SEC regulations standardizing climate-related disclosures, this year’s conference held particular relevance. The new SEC rules aim to boost transparency and accountability in environmental financial reporting, emphasizing a shift toward more accountable practices.

QUICK VIEW: the takeaways

Attendees immersed themselves in the complete carbon picture —from production forecasting and reserves to emissions forecasting. They had the opportunity to network and explore emissions awareness, regulatory education, and the economic advantages of emission reduction—all crucial for driving sustainability and enhancing operational efficiency in energy.

IN CASE YOU MISSED IT

Day 1

The sessions, panels, talkbacks and networking opportunities at the conference significantly advanced conversations on sustainability and financial viability within the oil and gas industry. Insights from some of the sector’s top minds spurred critical dialogue on compliance and investment protection, improving our understanding and approach.

1. Climate-Related Disclosures: The SEC’s Final Rules

William Turner (Ryder Scott) unpacked the SEC’s new climate-related disclosure rules, providing essential insights for companies navigating these regulations.

“They [the SEC] wants to know more than what our industry has had to disclose before […] Adhering to the SEC climate rules by taking proper and informed actions will not only improve financial confidence but also reduce the risk of regulatory issues.” – William Turner, Ryder Scott

2. Compliance with Emerging ESG Regulation

Taylor Pullins (White & Case LLP) discussed the landscape of ESG regulation compliance, offering strategies for companies to stay ahead, and the importance of sustainability in corporate reporting.

“I not only look at these [ESG] disclosures as a breakdown of silos and barriers, but as a convergence of data – and data is very powerful… Timing and readiness is so important when it comes to credibility and reliability of ESG disclosures. It takes time and significant efforts to provide ESG disclosures – coordination is key and it’s important to be deliberate and I have found it’s a very time-intensive process.” Taylor Pullins, White & Case

3. Strategies for Low-Carbon Development in Mature Basins

Sustainable development strategies for mature basins, highlighting the shift towards low-carbon energy sources, with Fernando Tamayo (Welligence).

“The industry and the public are in alignment right now – we know we want to decarbonize these operations. We are running out of time to meet these energy transition goals, and it is going to be a challenge – as we have seen there are long lead times related to these efforts. However, there are some short term efforts that could be addressed in relatively short time frames with relatively lower costs.” – Fernando Tamayo, Welligence

4. Panel Discussion on Emissions and Regulation

Moderated by Marylena Garcia, featuring Taylor Pullins (White & Case LLP), William Turner (Ryder Scott), and Fernando Tamayo (Welligence), leading experts answered questions related to presentations from the first part of the day. They share their diverse perspectives on navigating the energy sector’s evolving landscape, impacts and challenges of ESG disclosures, and maintaining sustainability within mature basins.

5. Integrating Asset Valuation with GHG Emissions Analysis

Francesco Riva (ENI) discussed the interaction of GHG emissions analysis with asset valuation, offering a new approach to eco-financial accountability.

“This is a new topic – there aren’t any references. There is no one-expert. It’s interdisciplinary, we need to sit down with many experts. If you’d like to have coherence between reserves and emissions, we need to conduct evaluations with a project-based approach, building up a field view, asset view and company view. Having a methodology like this is crucial if a company wants to have a mid- to long-term view of not just emissions, but also of reserves. And if we have a monitoring tool, it needs to be flexible and pragmatic to be used over time. We have to couple the current reserves view with the current vision for emissions.” – Francesco Riva, ENI

6. ComboCurve Workflow: Forecasting Emissions Associated with Reserves

ComboCurve’s Doug McMaster and Vahid Shabro detailed how our all-inclusive platform integrates emissions forecasting with reserve economics, and the impact on sustainability and financial strategy.

“Reducing emissions can increase the value of your assets in certain cases, which is also an indicator of how you should prioritize your projects. Emissions can impact your economics and reserves based-lending. We should make It easy on other providers in the industry – we have to upgrade the skill set and the intuition in the minds of the modelers. A lot of the emissions we have are ahead of us, not behind us. A lot of current emissions reporting in the industry is the last years.” – Doug McMaster, ComboCurve

“ComboCurve enables you to navigate these uncharted territories we’re in– it’s new for all of us. You’ll have the tools to benchmark and reduce your emissions with minimum or without adverse economic impact. A unified workflow means that in the same place that you generate reserve and cash flow estimates for your wells, you will generate emissions that you will have on your book for the life of those wells. Moreover, ComboCurve enables you to input waste emission charges into your analysis since emission, reserves and economics are modeled side by side.” – Vahid Shabro, ComboCurve

7. Integrated Reserves and Emissions Case Study

William Turner (Ryder Scott) presented a case study on integrating reserves and emissions forecasting under a unified framework, and what’s possible with the data you’re working with.

8. Panel Discussion Connecting Sustainability to Reserves and Making Decisions as a Team

Second panel of the day with Doug McMaster (ComboCurve), Sarah Izzat (Oxy), Francesco Riva (ENI), and William Turner (Ryder Scott), moderated by Marylena Garcia (Ryder Scott). Discussed integrating sustainability with reserves management and collaboration strategies to achieve both environmental and economic objectives.

9. CCS Validation & Verification: A Geologic Perspective

Rob Decesari (Ryder Scott) shed light on the geological aspects of CCS validation and verification, essential for painting the full carbon picture.

“The geological validation and verification process provides an additional level of comfort and confidence to regulators and investors, providing a comprehensive evaluation of projects from a subsurface standpoint.” – Rob Decesari, Ryder Scott

10. Third-Party Verification: Auditor Workflow

Marylena Garcia (Ryder Scott) gave us a detailed breakdown of the auditor workflow and considerations for CCS third-party verification – the process, compliance, best practices and how to improve project credibility.

“Third-party verifications require a multifaceted approach involving multiple disciplines. When we have third party verifications and geological assessments, we can provide the evidence that a project is viable, robust and safe as well as can guarantee the long-term containment of that CO2, providing some form of validation and trust to the investor and community.” – Marylena Garcia, Ryder Scott.

11. CCUS Value Chain – Capture and Sequestration Economics

Nikhil Joshi (Verde CO2) took us through the economics of the CCUS value chain, focusing on revenue opportunities from sequestration and the costs influenced by flue gas sources. He examined the deployment and economic assessment of capture technologies, their development and regulatory incentives.

“Corporations today are very much invested in decarbonization. Corporations today are also interested in the return on investment. At the end of the day, the incentives that the market provides is going to determine how the money gets spent.” – Nikhil Joshi, Verde CO2

12. Panel Q&A

Closing out Day 1 of Breaking the Barrier with a final Panel Q&A moderated by Doug McMaster (ComboCurve), featuring Rob Decesari (Ryder Scott), Marylena Garcia (Ryder Scott) Dan Diluzio (Chevron), and Nikhil Joshi (Verde CO2). Great insights covering CCS, implementation challenges, CO2 EOR storage, SRMS applications, and best practices.

Day 2 – Quick SnapShot

1. Navigating the SEC’s Final Climate Disclosure Rules

with the Ryder Scott team, William Turner, Marylena Garcia, and Herman Acuna. With the recent mandate for energy companies to disclose Scope 1 and 2 emissions, Ryder Scott explored the significant impact of these requirements on corporate climate reporting and how companies can strategically align with these new regulations for effective risk management.

2. Carbon Reserves Certification: Integrating Emission Forecasting, Economics and Reserves

As the conference drew to a close, we saved one of the most anticipated events for last—the exclusive Carbon Reserves Certification. Led by ComboCurve’s Travis Runge, Doug McMaster, and Vahid Shabro, the certification equipped participants with tools and strategies for integrating emissions forecasting with economic and reserves management, achieving significant emissions reduction while maintaining profitability and managing reserve risks. Over 70 people got certified at Breaking the Barrier!

If you’re interested in learning modeling, benchmarking, forecasting, and identifying reduction opportunities—all essential for supporting profitable, sustainable, and reliable operations in the oil and gas sector – check out the virtual certification course on April 30th at 1pm CST. Register here.

We’d like to thank Ryder Scott, White & Case, Welligence, Eni, Oxy, Verde CO2 and Chevron for their invaluable contributions and hope to see you next year!

See how your team can go from forecast to economics in minutes with energy’s fastest analysis engine.

Related Posts

September 29, 2022

The State of GHG Emissions Planning in Oil and Gas

Even the most ambitious energy transition plans still include the production and consumption of significant amounts of oil and gas until 2050 and beyond.

October 20, 2022

Three Reasons Oil & Gas Companies Are Planning for Net-Zero

Reduce exposure to regulations, create transparent future emissions forecasts to attract capital, and enable a balanced mix of sustainable energy sources.

October 22, 2022

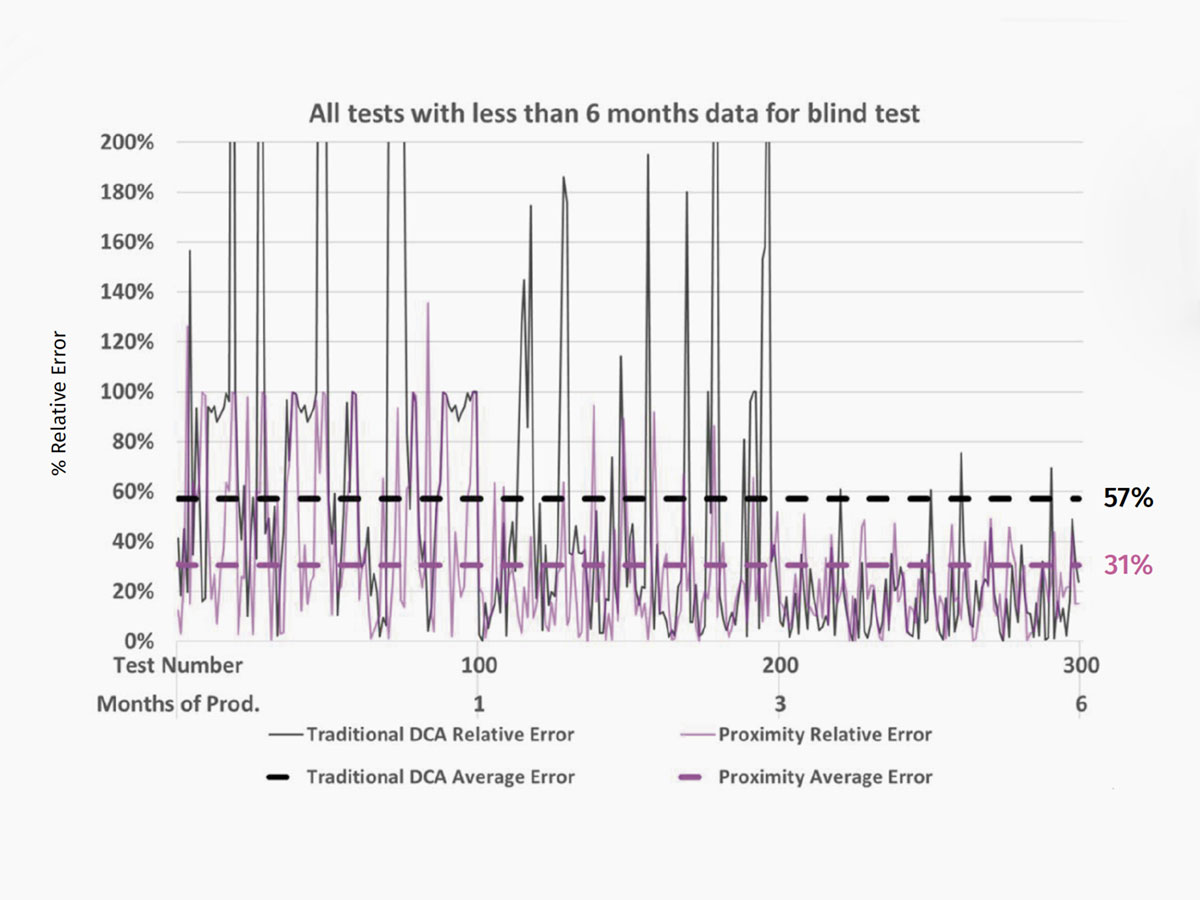

ComboCurve Proximity vs. Traditional DCA Forecast: A Comprehensive Comparison Study

ComboCurve’s proximity workflow generates a forecast with a much lower error compared to the traditional DCA.