Related Posts

Oil and Gas Midstream Software: Maximizing Efficiency

Allyson Kidwell explains how ComboCurve empowers midstream operators by providing a realistic view of gathering volumes, accurate production forecasting, and the ability to integrate multiple projections, enabling strategic planning, optimized resource allocation, and informed decision-making.

Security and Compliance at ComboCurve

ComboCurve is committed to safeguarding your data through rigorous security measures. We leverage advanced encryption standards and proactively conduct quarterly vulnerability assessments – performing 4X the industry standard of required testing. We employ third-party SOC auditors and penetration testers to ensure we are meeting and exceeding security program guidelines within our internal security program. Our focus is on keeping your data protected, compliant, and accessible to your authorized team members.

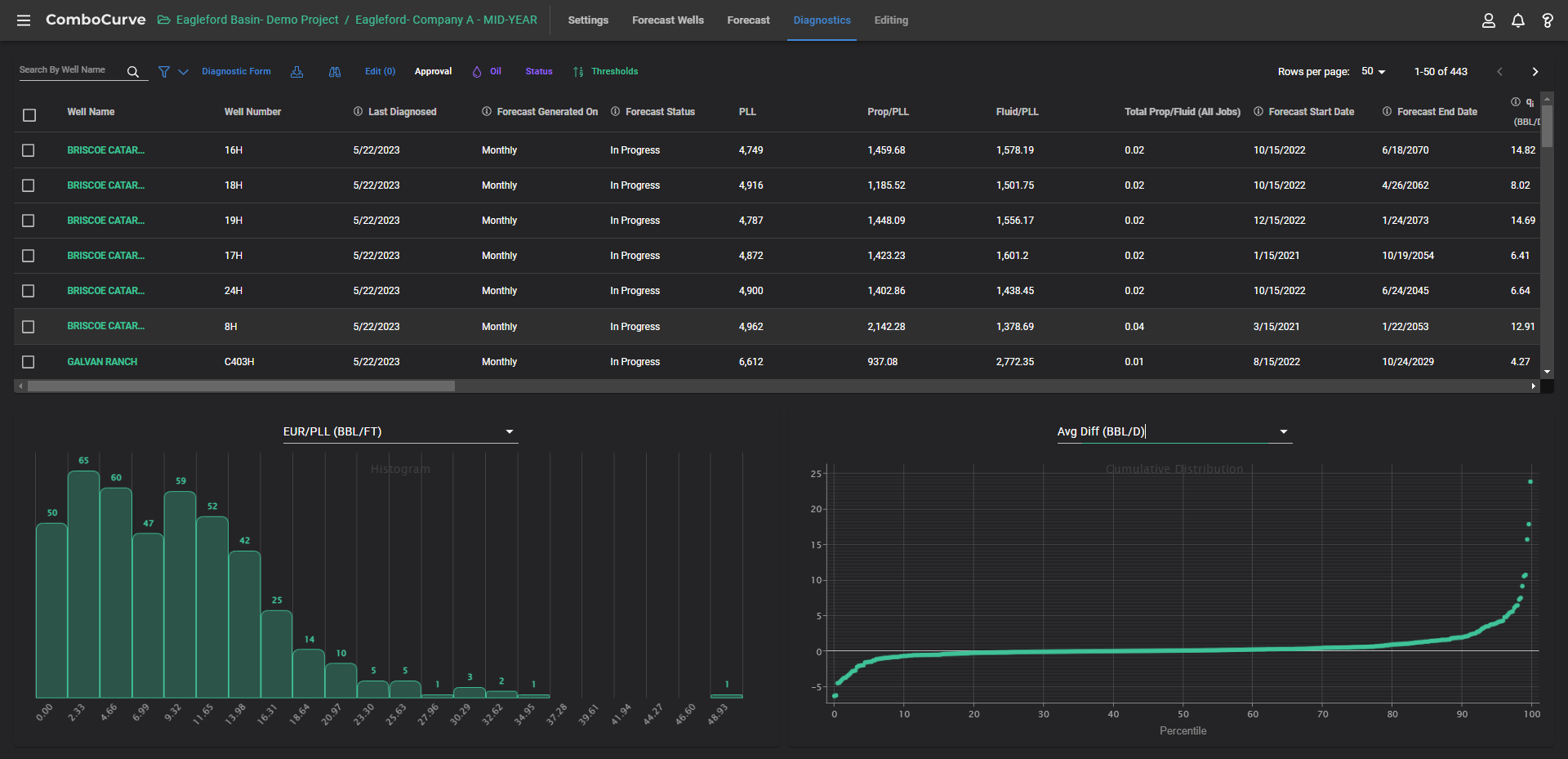

Oil and Gas Forecasting Software: How to Combat Complexity

Complex and siloed tasks present distinct hurdles across the energy sector. ComboCurve oil and gas forecasting software can help.