3 Ways to Maximize Your Mineral Returns with ComboCurve

Mineral acquisitions are fiercely competitive and demand timely action - if you want to get the best deals. Unlike non-op opportunities or overrides, where you have a few days to send in your deals, the energy industry has reached a point where fast action is crucial and not just beneficial for mineral acquisitions. Not to mention that even with rapid bid submissions, the acceptance rate can be low with only about 10% of submitted bids resulting in successful deals.

For those looking to maximize your mineral returns, we know time is money. Above all else, ComboCurve users have expressed how much time they are saving on deal evaluation.

Learn how Mineral and Royalty owners can leverage ComboCurve to evaluate the viability of potential investments more efficiently and effectively and raise the odds of securing lucrative mineral deals with more accuracy, confidence, and speed.

1. Deal evaluations in minutes, anywhere

“I’m probably twice as fast using ComboCurve.” – Marshall Porterfield, Partner, MAEVLO

With legacy workflows, valuations can take several days or weeks thanks to the time-consuming process of coordinating spreadsheets. Hopping between disparate software platforms and third-party consultants costs time.

Addressing the inefficiencies faced in collaboration and deal evaluation, particularly when using Excel or legacy tools like ARIES, ComboCurve integrates forecasting, economic analysis, mapping, and scheduling into a singular platform allowing Mineral companies to assess the viability of a deal within minutes and also broaden the scope to explore a wider range of mineral deals – faster.

Rocking WW Minerals CEO Chris Beato says, “We only invest in the highest quality reservoirs under cost-efficient operators. This ensures our resources will get developed in a timely manner. Combo Curve is a cornerstone in our technology platform that enables us to routinely forecast production and economically evaluate over 20,000 wells on a quarterly basis.”

Moreover, while ARIES is local to your machine, ComboCurve uses cloud computing. This distributes the workload across thousands of servers, allowing for remote access and operation from any location.

2. Streamlining Risk Assessment with ComboCurve

Understanding a well’s First Production Date is important for mineral companies as it directly impacts the well’s present value (PV). However, as they typically don’t operate the wells themselves, they lack direct insight into operators’ drilling schedules. Misestimating production timelines—expecting a well to produce in 3 months when it might take 12—can significantly impact cash flow projections.

Legacy evaluation tools often require spending days on economic analyses to quantify risk over different time frames (3, 6, 9, or 12 months).

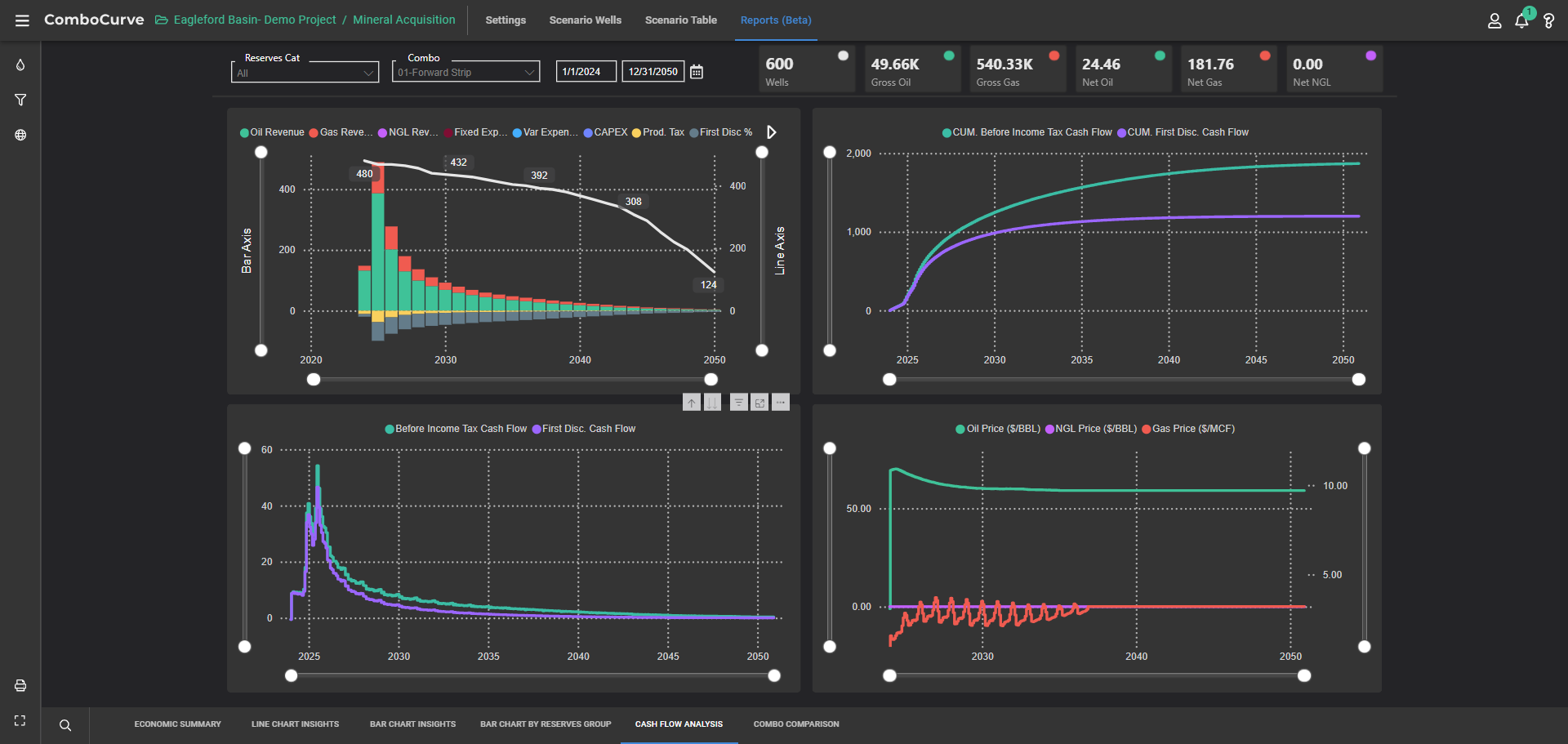

ComboCurve eliminates these inefficiencies by leveraging cloud computing to perform multiple scenario analyses concurrently, considering various sensitivities. This allows for a significantly faster evaluation of how scheduling or price changes affect deal risks. Providing a clear and immediate understanding of each deal’s risk without the delays and limitations of legacy systems.

3. Accurate Proximity Forecasting

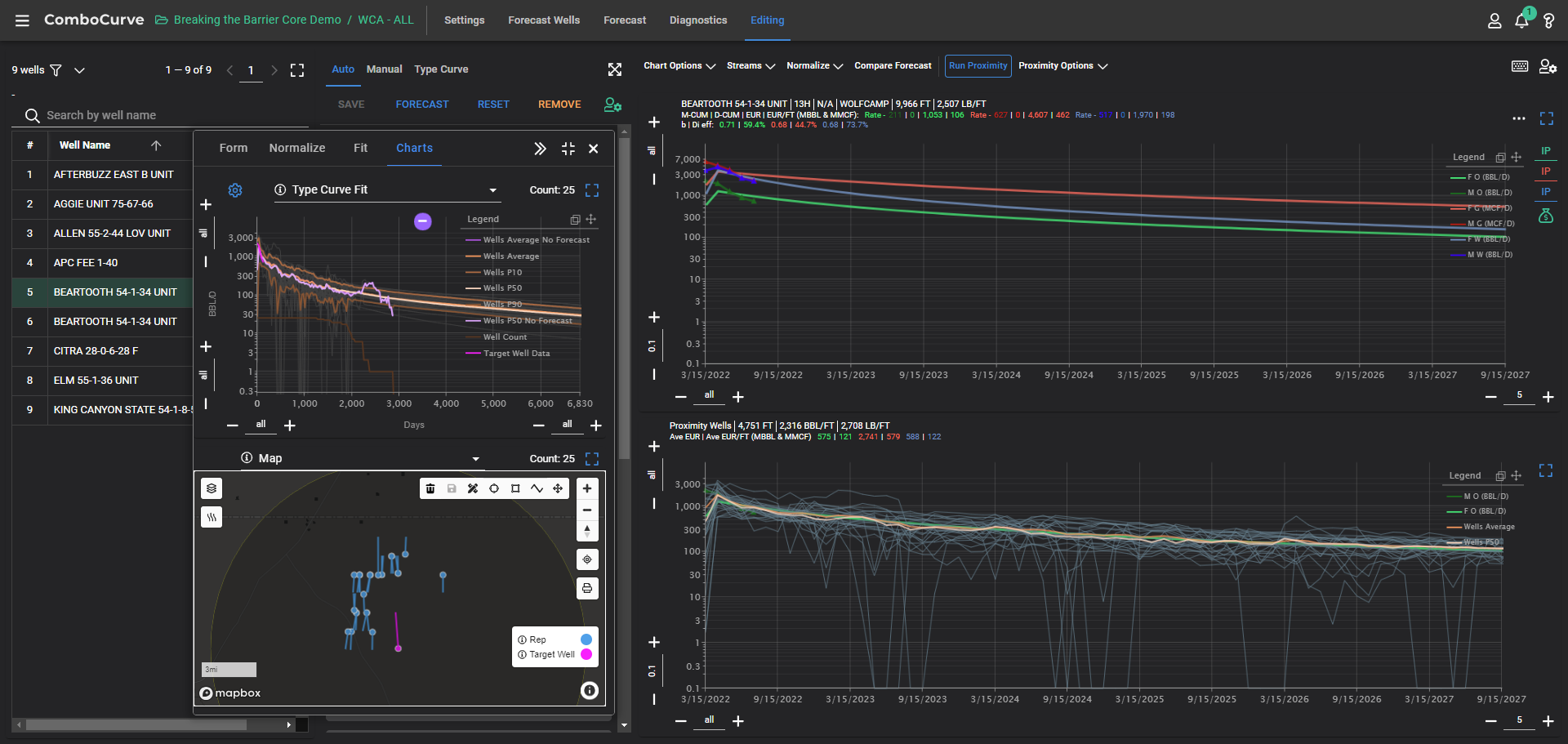

When traditional forecasting falls short due to a well’s limited historical data or if it’s in an area they haven’t invested in before, the next step is to review and analyze offset wells to forecast how an asset will perform over time accurately.

ComboCurve’s proximity forecast tool, embedded within the forecasting module, offers a solution to maximize your mineral returns This feature automates forecast generation from nearby well data, applying adjustments such as Linear, 1-to-1, or Power Law Fit, alongside setting production limits and tweaking decline parameters. This not only increases the precision of forecasts but also turns data into actionable insights, streamlining the decision-making process for mineral and royalty owners. Moreover, the proximity type curve tool executes the type curve analysis during forecasting, running multiple economic scenarios and sensitivity analyses simultaneously, proving to be a significant time-saver while streamlining the path to informed decision-making and maximizing investment returns.

Other Benefits

Heat Mapping

ComboCurve enhances the visualization of PV10 values across different regions. This enables Mineral and Royalty shops to effectively evaluate the investment potential of specific areas according to their criteria. By conducting a PV10 economics run within ComboCurve, users can apply these values directly to a heat map. Simplifying the process of identifying high-value investment locations and making well-informed decisions.

ComboCurve can dynamically create a heat map with the click of a button.

Easy to use – Minimal Learning Curve

“It’s very user-friendly and honestly when you learn it, it really speeds up a lot of our vetting on deals.” – Marshall Porterfield, Landmand & Partner, Maevlo

ComboCurve is not only a tool for petroleum engineers, it’s a tool for everyone. From solo business owners managing every facet of their operations to large companies with specialized departments, and teams of landmen and technicians sourcing, evaluating, and closing deals, ComboCurve’s straightforward, quick-to-master interface makes inaccessible legacy systems such as ARIES or PhDWin a thing of the past.

ComboCurve effectively helps individual investors maximize their mineral returns and sizable firms narrow the resource and expertise gap, serving as a single, accessible platform for a wide range of operational complexities.

See how your team can go from forecast to economics in minutes with energy’s fastest analysis engine.

Related Posts

October 3, 2023

Commit to ComboCurve for Reserves

Luke Cone joined ComboCurve a few years ago to contribute to streamlining reservoir engineering processes. His subsequent move to Grit Oil & Gas saw him advocating for ComboCurve's integrated solutions, specifically in using ComboCurve for reserves.

January 17, 2023

ComboCurve Disrupts Energy Industry Awards Season

"We have an incredibly skilled team of passionate people solving important problems. ComboCurve is thrilled to be recognized as a leader in energy expansion."

August 7, 2023

Reservoir Efficiency: Selenite Energy Partners’ Experience with ComboCurve

As the Chief Operating Officer of Selenite Energy Partners, a structured capital finance company, Lindsey McCarty has been navigating the nuances of oil and gas for over 15 years.