CounterPoint Analytix Adopts ComboCurve to Accelerate Investment Decisions in Oil and Gas

Solutions

Industry

See how your team can go from forecast to economics in minutes with energy’s fastest analysis engine.

Challenge

CounterPoint Analytix, a strategic consulting firm for alternative capital providers, grappled with the task of consistently finding and assessing investment opportunities in the oil and gas sector. Paul, the founder, needed to perform thorough due diligence, establish clear capital arrangements, and promptly complete investment deals. Traditional tools and methods fell short in handling the swift and dynamic nature of the sector. Handling increasing data volume and the intricacies of debt capital investments became a considerable hurdle for CounterPoint Analytix.

Solution & Impact

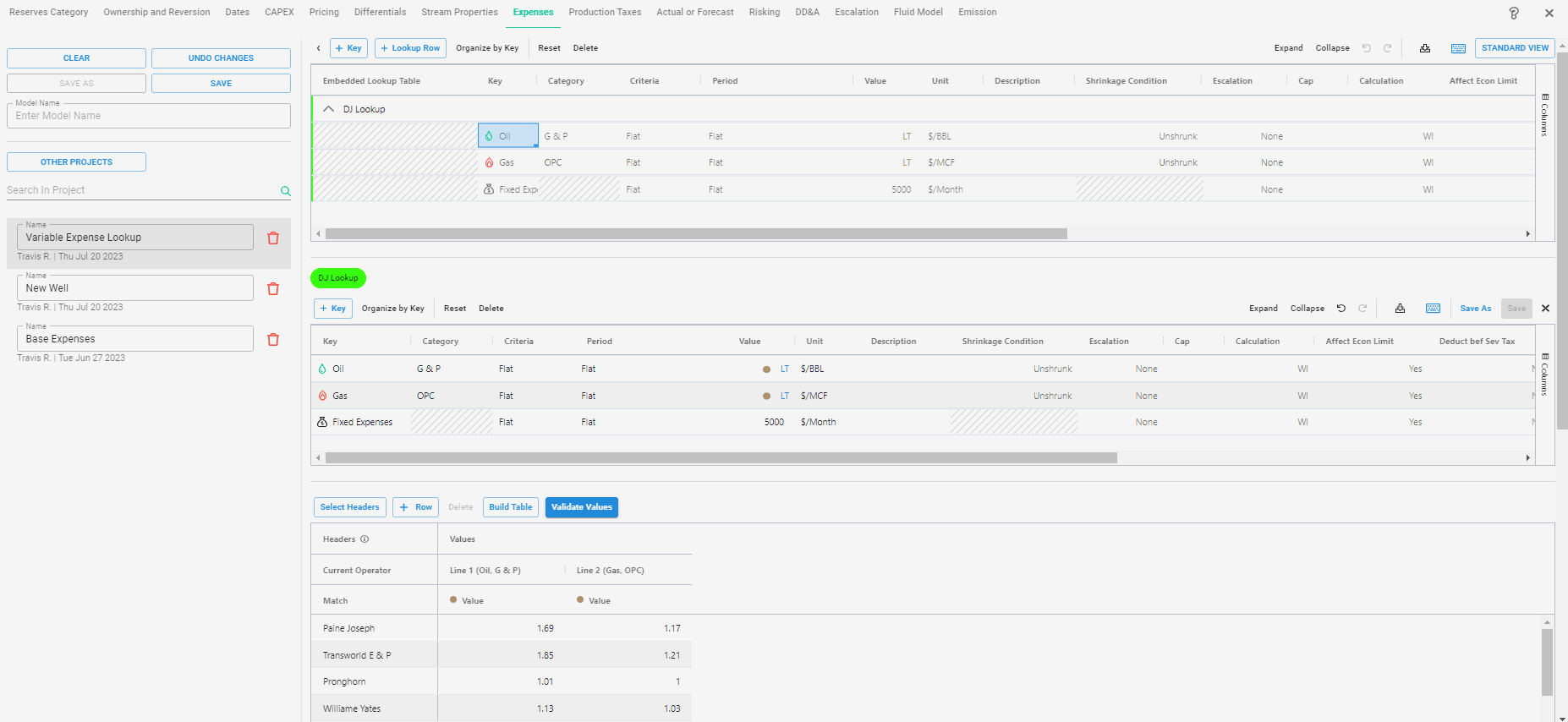

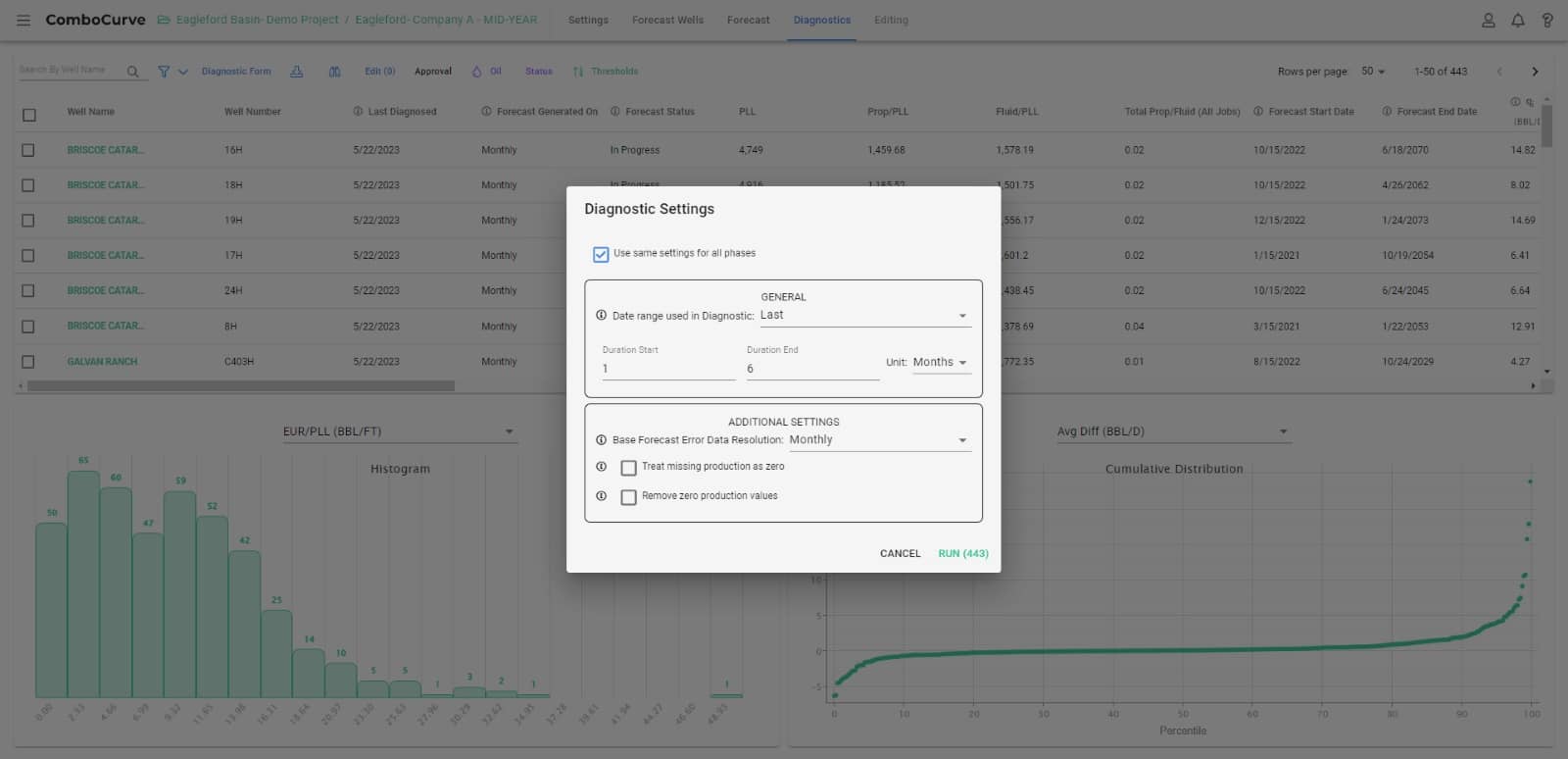

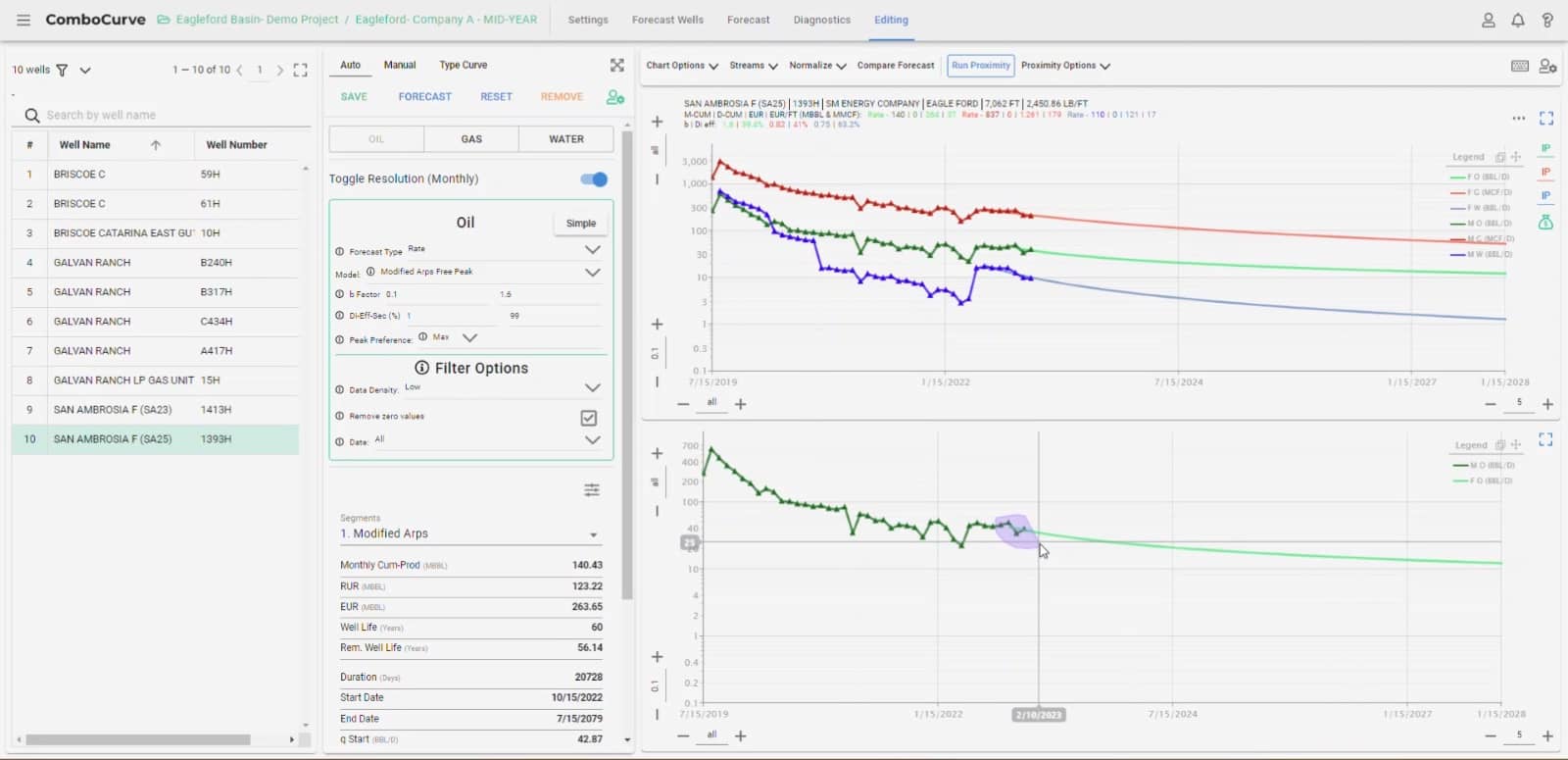

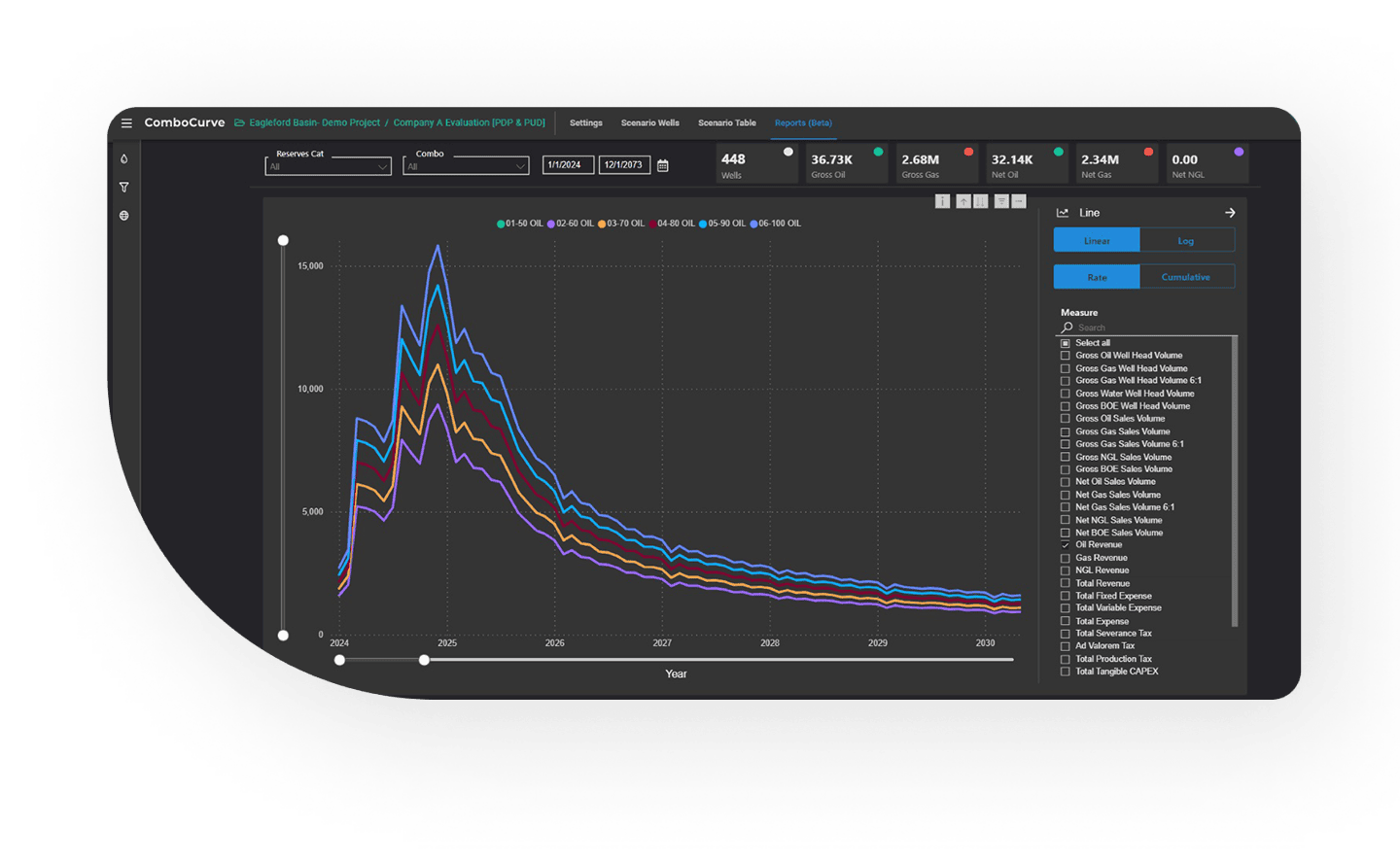

Paul used ComboCurve to overcome his challenges with managing production trends. Instead of juggling multiple software applications, he analyzed historical production trends and performed decline curve analysis all in one place. This streamlined process greatly improved his strategic approach. In just about fifteen minutes, Paul could thoroughly understand the assets, build different scenarios, and check if the forecasts matched his preferred level of conservatism.

Additionally, ComboCurve promoted better collaboration within the firm. The platform moves fast enough to adjust and update economic models during Zoom meetings. Paul and his colleagues can tackle concerns and have effective conversations that foster sound decisions.

Before implementing ComboCurve, CounterPoint Analytix relied heavily on Excel for analytical work. However, the lack of standardization in reserve methods led to potential errors and oversights. ComboCurve mitigated these issues by providing a standardized framework for reserve calculations. This led to a new era of reliability and precision in the firm’s investment strategies.

As a result of these improvements, CounterPoint Analytix started getting noticed for its swift due diligence and deal execution. This strengthened the firm’s standing in the market. Additionally, ComboCurve’s ability to bring transparency to reporting and decision-making processes led to a marked improvement in the firm’s results.

CounterPoint Analytix's Return on Investment

The way CounterPoint Analytix transitioned to ComboCurve underscores how modern technology transforms even the most conventional sectors. This change does more than conserve resources and time; it fine-tunes decision-making processes and enriches the quality of results, thus boosting business value. This case vividly illustrates the significant benefits businesses actively obtain when they strategically incorporate the right digital solutions.

Superior Customer Service

Engaging with ComboCurve's customer service, whether through emails, phone calls, or direct meetings, significantly bolstered the firm's confidence in the software.

Improved Analytical Capabilities

CounterPoint Analytix replaced its error-prone Excel workflows with ComboCurve, a more reliable and precise method of analyzing investment opportunities.

Time Savings

ComboCurve saved CounterPoint Analytix time by automating many of the tasks involved in evaluating investments. This freed up resources that could be used for more strategic tasks, such as developing new investment strategies and identifying new investment opportunities.

Enhanced Collaboration

ComboCurve's collaborative features made it easier for team members to share information and ideas, leading to more transparent communication and effective discussion. This, in turn, contributed to better decision-making within the firm.

Smooth Transition and Quick Adoption

Switching to ComboCurve was a smooth process thanks to its intuitive user interface and the dedicated support team.